The insurance industry is currently undergoing a structural metamorphosis driven by the rapid evolution of artificial intelligence. As of December 18, 2025, the conversation has shifted from the theoretical potential of machine learning to the practical, large-scale deployment of autonomous systems. Carriers that successfully integrate these technologies are no longer just improving efficiency: they are fundamentally redefining the value proposition of insurance.

- The State of Insurance AI in Late 2025

- Strategic Pillar 1: Transformation of Underwriting and Submission Intake

- Strategic Pillar 2: Revolutionizing Claims Processing and Triage

- Strategic Pillar 3: Predictive Risk Management and Prevention

- Strategic Pillar 4: The Rise of Agentic AI and Autonomous Operations

- Overcoming Barriers to AI Maturity

- Data Readiness and Legacy Systems

- Talent Shortage and Workforce Upskilling

- Regulatory Compliance and Ethical AI

- Preparing for the 2026 Competitive Landscape

To ensure effective AI in insurance operations, organizations must move beyond isolated pilot programs and embrace a holistic, enterprise-wide strategy. This involves aligning technological capabilities with regulatory requirements, ethical standards, and customer expectations. This guide explores the critical pillars of AI integration, providing actionable insights for the modern insurance leader.

The State of Insurance AI in Late 2025

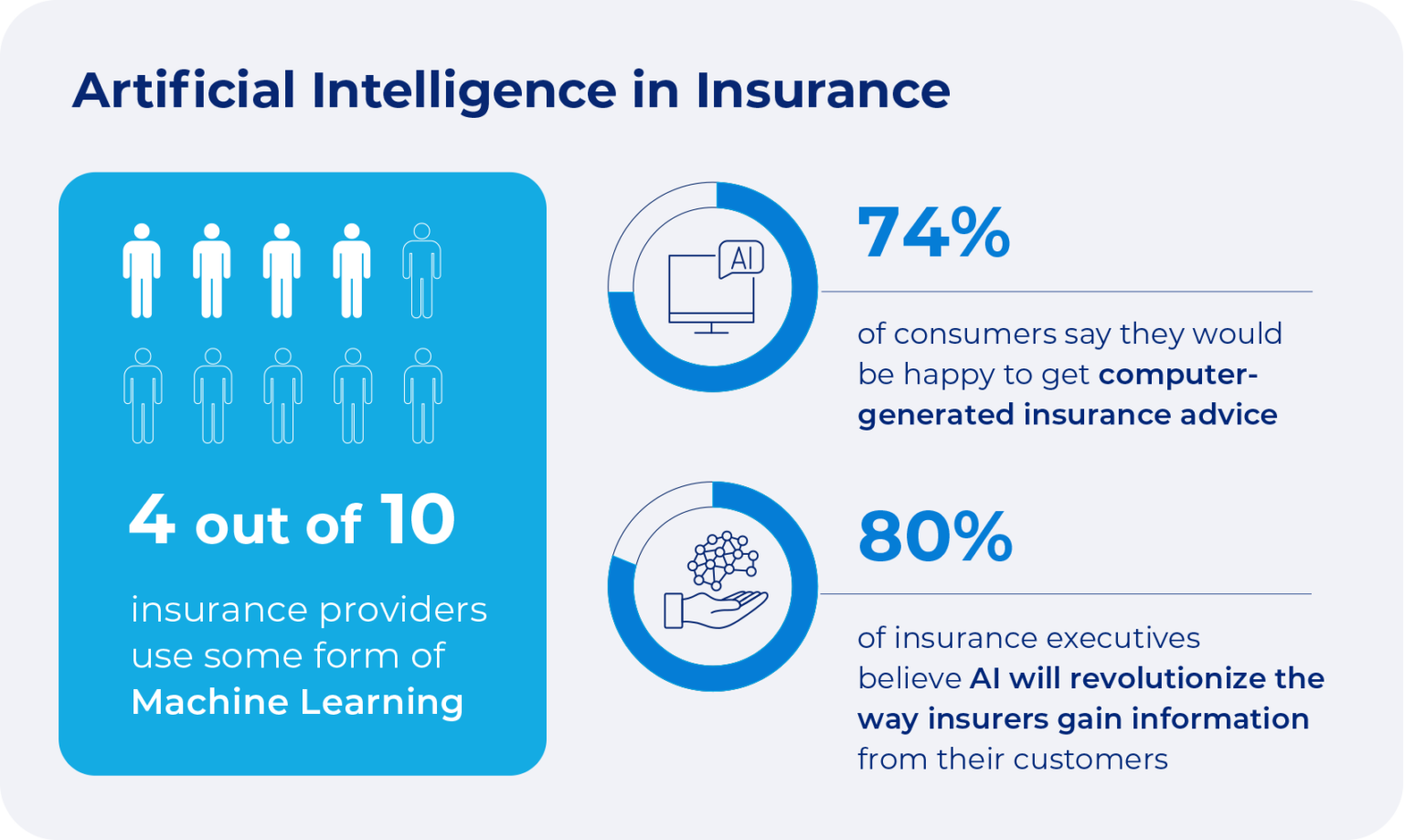

The global insurance landscape has reached a pivotal junction. According to recent data from the International Association of Insurance Supervisors (IAIS) published in December 2025, AI adoption has become a primary supervisory priority as carriers seek to navigate geoeconomic fragmentation and rising operational costs. While over 78 percent of property and casualty insurers have adopted some form of generative AI, the industry remains in a “scaling” phase.

Today, the focus is on Agentic AI: systems that do not just process data but take independent actions to achieve complex goals. Companies like Roots Automation and Zywave have recently unveiled specialized AI agents designed to handle submission intake, loss run processing, and prospect identification with nearly 98 percent accuracy. These developments represent a shift from reactive software to proactive digital colleagues.

Strategic Pillar 1: Transformation of Underwriting and Submission Intake

Underwriting is the heart of insurance, and it is here that AI is delivering the most immediate return on investment. The goal for 2026 is “Straight Through Processing” (STP) for a majority of standard risks, allowing human underwriters to focus exclusively on complex, high value accounts.

Automated Submission Management

One of the greatest bottlenecks in commercial insurance has traditionally been the manual intake of broker submissions. Modern AI agents now utilize Natural Language Processing (NLP) and Intelligent Document Processing (IDP) to extract data from unstructured emails, ACORD forms, and loss runs.

These systems can:

- Identify missing information in real time and automatically query brokers for clarification.

- Enrich internal data with external sources, such as NAICS codes, company size, and revenue from third-party databases.

- Prioritize submissions based on their alignment with the carrier’s current risk appetite.

Predictive Modeling and Risk Assessment

Advanced machine learning models are now capable of analyzing thousands of variables simultaneously. Beyond historical loss data, these models incorporate real-time feeds from IoT devices, satellite imagery, and telematics.

In life insurance, for instance, AI is increasingly used to assess health risks based on wearable data and behavioral patterns rather than relying solely on invasive medical exams. This transition reduces the policy issuance time from weeks to minutes, significantly improving the customer experience and increasing the bind rate.

Strategic Pillar 2: Revolutionizing Claims Processing and Triage

The claims department is often the only touchpoint where a customer experiences the true value of their policy. Ensuring effective AI here is critical for maintaining loyalty and reducing the combined ratio.

Full Automation of Simple Claims

-frequency, For high-frequency, low-severity claims, such as minor auto accidents or property damage, AI can handle the entire lifecycle. Digital platforms now allow customers to upload photos of damage which are then analyzed by computer vision algorithms. These algorithms can estimate repair costs, verify policy coverage, and initiate payments in a matter of hours.

Recent industry reports indicate that carriers using an end-to-end AI approach in claims have achieved a 35 percent boost in productivity. By reducing the settlement cycle, insurers also lower the “claims leakage” associated with administrative delays and prolonged litigation.

Advanced Fraud Detection

Insurance fraud remains a multibillion-dollar challenge. Traditional rule-based systems often fail to catch sophisticated, cross-carrier fraud rings. AI models, however, excel at detecting subtle patterns and anomalies across vast datasets.

By analyzing social connections, geolocation data, and historical claims patterns, AI can flag suspicious activity before a payment is issued. These systems are “always on,” continuously learning from the feedback provided by human investigators to refine their detection capabilities.

Strategic Pillar 3: Predictive Risk Management and Prevention

The most significant shift in the 2025 insurance market is the move from “Protect and Recover” to “Predict and Prevent.” This strategy uses AI to mitigate risks before they result in a loss, a win-win scenario for both the insurer and the policyholder.

The Role of Telematics and IoT

In commercial fleet insurance, AI-powered telematics monitor driving behavior in real time. Systems can alert fleet managers to risky patterns, such as sudden braking or excessive speeding, allowing for proactive coaching. Similarly, in property insurance, IoT sensors for water leaks or fire detection can trigger automated shutoff valves, preventing catastrophic damage.

Climate Risk Mapping

As natural catastrophes become more frequent and severe, AI is being deployed to map climate risks with granular precision. Using deep learning models to analyze meteorological data and historical loss locations, insurers can adjust their pricing models dynamically and provide policyholders with specific recommendations for property fortification.

Strategic Pillar 4: The Rise of Agentic AI and Autonomous Operations

The latest trend for 2026 is the deployment of “AI Agents.” Unlike traditional chatbots that follow a fixed script, Agentic AI uses advanced reasoning models (like those found in Gemini 2.0 or OpenAI o1) to navigate multi step workflows.

These agents can:

- Perform premium audits with over 98 percent accuracy.

- Manage policy servicing requests by updating endorsements and issuing certificates of insurance.

- Conduct research on prospective households and companies to identify coverage gaps.

The implementation of “cockpit” systems allows human managers to oversee these agents, assigning work and monitoring results in real time. This ensures a “human-in-the-loop” model where AI handles the volume and humans handle the exceptions.

Overcoming Barriers to AI Maturity

Despite the rapid progress, a recent McKinsey report notes that only 1 percent of insurance leaders believe their companies have reached AI maturity. Several obstacles must be addressed to ensure effectiveness.

Data Readiness and Legacy Systems

Fragmented and siloed data remain the biggest hurdles. Many insurers are moving from traditional data lakes to “Data Lakehouses,” which combine the flexibility of a lake with the performance of a warehouse. Effective AI requires high quality, clean, and accessible data. Modernizing legacy platforms is not just a technical necessity but a strategic mandate.

Talent Shortage and Workforce Upskilling

There is a growing gap between the demand for AI expertise and the available talent pool. Insurance companies must focus on recruiting data scientists and machine learning engineers while simultaneously upskilling their existing workforce. Employees need to view AI as a “career co-pilot” that removes tedious tasks, rather than a threat to their job security.

Regulatory Compliance and Ethical AI

Regulators, including the IAIS and national authorities, are increasingly focused on model governance and transparency. Insurers must ensure that their AI models are explainable and free from discriminatory bias. This is particularly important in underwriting and pricing, where biased algorithms could lead to unfair treatment of certain demographic groups.

To mitigate these risks, companies should:

- Implement robust governance frameworks for AI development and testing.

- Use diverse and representative training data.

- Conduct regular audits of AI outputs to ensure fairness and accuracy.

Preparing for the 2026 Competitive Landscape

The window for experimentation with artificial intelligence is rapidly closing. In 2026, competitive advantage will be determined by execution: the ability to implement AI at scale and integrate it into core business functions. By focusing on data quality, ethical governance, and the emerging power of Agentic AI, insurance organizations can build a resilient, efficient, and customer centric operation.

The future of insurance is not just about paying for losses, it is about using intelligence to prevent them. Organizations that embrace this shift will lead the market into a new era of innovation and growth.

Would you like me to develop a specific case study focusing on AI implementation for a particular line of insurance, such as Commercial Property or Life & Annuities?