Introduction:From boom to pause

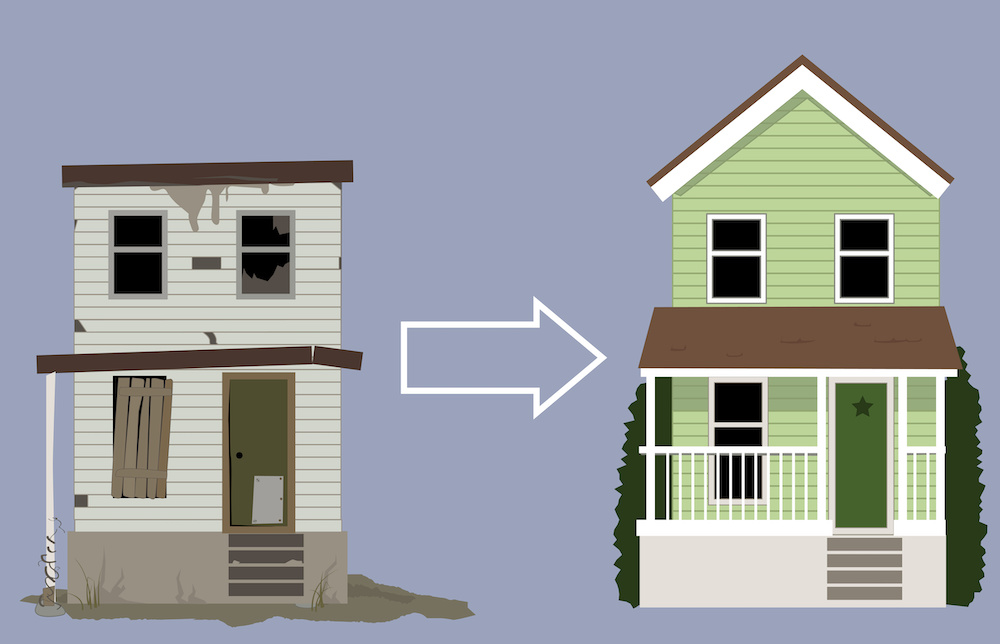

For years, house flipping seemed unstoppable. The formula was simple enough: buy an undervalued property, put in the necessary renovations, and sell it for a significant profit.

- Introduction:From boom to pause

- Why flipping has lost its shine

- Financing challenges

- Escalating renovation costs

- Slower buyer demand

- Insurance and regulatory pressure

- Institutional shifts

- The numbers behind the slowdown

- Regional differences in flipping viability

- Implications for investors, sellers, and communities

- Practical strategies for investors in today’s market

- Practical guidance for homeowners and sellers

- Long-term outlook:a reset, not a collapse

- Conclusion:adapting to new realities

Investors rode this wave across countless markets, encouraged by low interest rates, rising home values, and strong demand from eager buyers. Entire television shows were built around the glamour of quick transformations, while everyday investors tried to replicate what seemed like a proven strategy.

Yet, the story is changing. Reports now show that Investors are stepping back. Many who once saw flipping as a guaranteed way to build wealth are realizing that the dynamics have shifted.

The conditions that fueled the boom cheap financing, steadily appreciating home prices, and predictable demand are no longer as reliable. Costs are rising, buyers are cautious, and financing has become more expensive. What was once a high-return playbook now carries far more risk.

Why flipping has lost its shine

Financing challenges

One of the clearest reasons Investors are retreating from flipping lies in financing. Flips rely heavily on borrowed money, whether through short-term loans, mortgages, or hard-money lenders.

When interest rates were historically low, carrying costs were manageable. A project could stretch out for several months without destroying profit margins. T

oday, however, higher rates mean that every additional week a property sits unsold becomes more expensive. Investors who once budgeted comfortably for these costs now find themselves watching profits evaporate as borrowing eats into potential returns.

Escalating renovation costs

Financing alone doesn’t explain the shift. Renovation costs have also climbed, and not in small increments. Lumber, roofing, electrical systems, and even the price of skilled labor have risen, sometimes unpredictably.

A few years ago, a budget renovation could be planned with some degree of certainty. Today, unexpected supply chain disruptions and labor shortages often mean projects take longer and cost more than expected.

For an investor, those overruns can turn a profitable flip into a barely break-even deal.

Slower buyer demand

Another force at play is the buyer side of the equation. A flip only makes sense if there are eager buyers willing to pay a premium for a renovated home.

When the housing market was red hot, homes sold within days, often above asking price. Buyers were willing to stretch budgets, and flippers benefitted from the frenzy. Now, in many markets, demand has cooled.

Buyers are more cautious, driven by high mortgage rates and affordability challenges. A flipped property that might have once sold instantly may now linger on the market, draining holding costs and forcing sellers to make concessions.

Insurance and regulatory pressure

In certain regions, Investors face additional hurdles in the form of insurance and regulatory issues. Some states are experiencing skyrocketing insurance premiums due to climate-related risks, while others have tightened rules around property transactions or renovations.

For example, higher stamp duties or stricter permitting processes can eat into margins. In markets where taxes and renovation expenses already strain profits, these additional costs create yet another reason for Investors to pull back.

Institutional shifts

Finally, there is the matter of institutional Investors. Over the past decade, large firms and private-equity groups entered the flipping game in a big way. Their bulk purchases sometimes reshaped entire neighborhoods, driving up competition and pricing out smaller Investors.

Yet even these big players are rethinking their strategies. Many are slowing down acquisitions or pivoting toward long-term rental holdings instead of short-term flips.

When institutions pull back, it sends a strong signal: margins are not what they used to be, and risks are rising.

The numbers behind the slowdown

Statistics confirm that flipping activity is cooling. Data from housing market trackers show a decline in investor purchases of single-family homes.

National Mortgage Professional reports that investor activity has dropped to some of the lowest levels seen in recent years, while Realtor.com highlights that profits from flips are shrinking. Where flippers once expected double-digit returns, many are now settling for slim margins or facing outright losses.

This doesn’t mean flipping has vanished altogether. Certain markets remain active, especially where home prices are still relatively affordable, and renovation costs are easier to manage. However, the broad national momentum has weakened, and flipping is no longer the seemingly easy money it was just a few years ago.

Regional differences in flipping viability

Not every market is suffering equally. Flipping has always been a hyper-local business, and regional differences remain stark. Investors in lower-cost markets, such as parts of the Midwest, continue to find opportunities.

In these areas, home prices are modest, renovation costs are more manageable, and demand remains stable. A $120,000 home that can be upgraded and resold for $160,000 still presents an attractive margin for a disciplined investor.

By contrast, coastal cities and high-cost metropolitan areas have become increasingly difficult places to flip. In California, for example, elevated home prices, high property taxes, and lengthy permit processes make quick flips less appealing.

When combined with surging insurance rates in climate-sensitive areas, the risk-reward balance tips against investors. The Financial Times has documented similar challenges in the UK and Europe, where transaction taxes and renovation expenses have reached levels that discourage short-term property speculation.

These differences highlight an important lesson: flipping success is never just about national trends but about micro-markets. What works in one neighborhood can fail completely a few blocks away.

Implications for investors, sellers, and communities

The cooling of the flipping market has ripple effects. For Investors, the message is clear: the easy money era is over, and deals must now be scrutinized with more discipline.

Investors who thrive in this environment are those who adapt, who build strong contractor relationships, and who plan conservatively for financing and resale timelines.

Sellers, too, feel the impact. During the boom, homeowners with fixer-uppers could often count on investors to swoop in with all-cash offers, eager to secure inventory.

With fewer active investors, those offers are less common. Sellers may need to focus more on appealing directly to owner-occupiers, which often means pricing more realistically, making modest pre-listing improvements, or offering concessions.

Communities also experience change. In some neighborhoods, flippers helped revitalize older housing stock, bringing neglected properties back to life. A pullback in flipping could mean fewer renovations, slower revitalization, and potentially more homes sitting in disrepair.

On the other hand, critics of flipping argue that speculative activity drove up prices and reduced affordability. From that perspective, a slowdown might actually benefit long-term residents by cooling housing inflation.

Practical strategies for investors in today’s market

For Investors still interested in flipping, success requires a different mindset. Gone are the days of quick cosmetic changes yielding outsized returns. Instead, Investors should plan for more conservative profits and longer timelines. A key strategy is stress-testing budgets.

By building scenarios that include higher renovation costs, longer holding periods, and lower resale prices, Investors can evaluate whether a deal holds up under pressure. If the numbers don’t work in a worst-case scenario, it’s better to pass than to gamble.

Another approach is to focus renovation dollars on improvements with the highest return on investment. Kitchens and bathrooms remain perennial favorites, as do upgrades to energy efficiency and curb appeal.

The goal is not to over-renovate but to make targeted improvements that resonate with buyers. Investors who keep renovation scopes tight and manageable often weather unpredictable costs more effectively.

Relationships with contractors have also become crucial. In many markets, the shortage of skilled labor can derail even well-planned projects. Investors who cultivate reliable contractor networks, negotiate clear terms, and maintain open communication will have a significant advantage over those scrambling for last-minute help.

Finally, financing flexibility is more important than ever. Some Investors are turning to lenders who offer bridge loans that can convert into longer-term financing, allowing the property to be rented if selling becomes difficult. This kind of adaptability ensures that a failed flip does not necessarily become a financial disaster.

Practical guidance for homeowners and sellers

For homeowners looking to sell, the reduced presence of Investors changes the strategy. Without flippers competing aggressively, homes that need substantial renovation may not attract quick offers.

This reality makes it more important for sellers to understand their buyer pool. Investing in smaller upgrades, such as fresh paint, landscaping, or minor system fixes, can broaden appeal.

Transparency has also become a valuable tool. Sellers who provide inspection reports and clear disclosures upfront reduce buyer uncertainty, which can help homes sell more quickly.

And with owner-occupiers becoming more important in the absence of investor demand, sellers should think less about quick cash offers and more about creating a property that feels livable and welcoming.

Long-term outlook:a reset, not a collapse

It is worth remembering that real estate is cyclical. The current slowdown in flipping is not the end of the practice but rather a recalibration.

Higher interest rates and cost pressures have forced the market to shed some of its speculative froth. In the future, flipping will likely be dominated by more experienced Investors who treat it as a disciplined business rather than a quick side hustle.

This evolution may ultimately be healthy for both Investors and communities. Fewer rushed, low-quality flips could mean better renovations and more sustainable neighborhood growth. It also suggests that flipping will remain part of the housing landscape, but in a more selective and professionalized form.

Conclusion:adapting to new realities

The days when flipping looked like a guaranteed goldmine are over. Investors are pulling back because financing costs are higher, renovations are more expensive, buyers are more cautious, and institutions are shifting strategies.

Yet opportunities remain. For disciplined Investors willing to stress-test deals, build reliable networks, and adapt to local conditions, flipping can still be profitable. For sellers and communities, the slowdown means recalibrating expectations but also opens the door for more sustainable market dynamics.

Flipping may no longer be a frenzy, but it is not finished. It has simply entered a new phase — one where skill, planning, and patience matter more than ever.